Did you know that investing in precious metals can help diversify your portfolio and potentially lead to long-term financial gain? While there are several options available, including gold, silver, platinum, and palladium, choosing the right ones is crucial for maximizing your profits. In this article, we will explore the best precious metals to invest in now and provide valuable insights on how to navigate the market successfully.

Key Takeaways:

- Diversifying your investment portfolio with precious metals can help mitigate risk and potentially provide long-term financial gain.

- The best precious metals to invest in now include gold, silver, platinum, and palladium, each with its own unique characteristics and advantages.

- Investing in precious metals offers benefits such as acting as a hedge against inflation, providing tangible assets, and offering liquidity.

- However, there are risks associated with investing in precious metals, including price volatility and potential correlation with the stock market.

- Understanding different investment options, such as physical metals, mining company stocks, precious metals ETFs, futures, and IRAs, is essential for making informed decisions.

Why Invest in Precious Metals?

Investing in precious metals offers several benefits for investors. These metals have historically served as a store of value, maintaining purchasing power through economic downturns and currency fluctuations. They are tangible assets that hold value beyond investment purposes and have a wide range of industrial applications. Additionally, precious metals can serve as a hedge against inflation and offer portfolio diversification.

Precious metals, such as gold, silver, platinum, and palladium, have long been recognized as a reliable store of value. Unlike traditional paper currency, which can be subject to depreciation or even collapse, precious metals have maintained their intrinsic value throughout history. Their durability and scarcity contribute to their appeal as long-term investments.

Moreover, precious metals offer tangible assets that can be physically owned. Unlike stocks or bonds that exist purely in digital or paper form, precious metals provide a sense of security and ownership. Investors can hold these assets in their hands, knowing that their value is not solely dependent on intangible concepts.

“Investing in precious metals is like owning a slice of history. These metals have been treasured by civilizations for centuries, and their value is likely to endure for generations to come.”

In addition to their longevity and tangibility, precious metals possess a wide range of industrial uses. Gold, for example, is highly sought after in jewelry manufacturing and electronics. Silver is used in solar panels, medical devices, and various industrial applications. Platinum and palladium are vital in the automotive industry, particularly in catalytic converters. This industrial demand helps to sustain the value of precious metals and provides additional support to their investment potential.

Furthermore, investing in precious metals can serve as a hedge against inflation. When the value of traditional currencies declines due to inflationary pressures, precious metals tend to appreciate in price. This inflation hedging characteristic makes them attractive for preserving wealth and maintaining purchasing power over time.

Finally, including precious metals in an investment portfolio offers diversification benefits. Precious metals have historically shown a negative correlation with other asset classes like stocks and bonds. This means that when stock prices decline, precious metals often rise in value, providing a cushion against market volatility.

The benefits of investing in precious metals—store of value, tangible assets, industrial demand, and inflation hedging—make them a compelling addition to any well-diversified investment strategy.

Comparison of Precious Metals

| Precious Metal | Store of Value | Tangible Asset | Industrial Demand |

|---|---|---|---|

| Gold | ✔️ | ✔️ | ✖️ |

| Silver | ✔️ | ✔️ | ✔️ |

| Platinum | ✔️ | ✔️ | ✔️ |

| Palladium | ✔️ | ✔️ | ✔️ |

Gold – A Timeless Investment

Gold is undoubtedly one of the most well-known and sought-after precious metals for investment purposes. Its historical significance as a store of value dates back centuries, making it a reliable and timeless asset in times of economic uncertainty. Gold has consistently demonstrated its ability to retain purchasing power, even during turbulent financial periods and crises.

One of the key advantages of investing in gold is its liquidity. Gold is easily bought and sold in various forms such as bars, coins, and exchange-traded funds (ETFs), allowing investors to enter and exit positions with relative ease. Its high liquidity makes it a popular choice for investors who value flexibility and the ability to quickly convert their investments into cash.

Gold also offers portfolio diversification benefits, thanks to its negative correlation with other assets such as stocks and bonds. When stock markets experience downturns, the value of gold tends to rise, serving as a protective hedge against market volatility. By including gold in a diversified portfolio, investors can potentially reduce overall risk and enhance long-term returns.

However, it’s important to consider the cons of investing in gold as well. Unlike stocks or bonds, gold does not generate any income. It is purely a speculative investment, reliant on capital appreciation rather than dividend payments or interest earnings. Additionally, storage costs should be taken into account when investing in physical gold, as secure storage facilities may incur expenses.

“Gold is a hedge against uncertainty, a tangible asset that can weather economic storms and preserve wealth.”

Investing in gold requires careful consideration of both the pros and cons. Its historical store of value, liquidity, and potential for portfolio diversification make it an attractive investment option. However, the lack of income generation and storage costs should be factored into the decision-making process.

| Pros of Investing in Gold | Cons of Investing in Gold |

|---|---|

| Historical store of value | Lack of income generation |

| Liquidity | Storage costs |

| Portfolio diversification |

Silver – An Affordable Option

Silver is an affordable precious metal investment option compared to gold. While gold is often associated with luxury and high value, silver provides a more accessible entry point for investors looking to diversify their portfolios with precious metals. Its relatively lower price per ounce allows individuals with smaller budgets to participate in the precious metals market.

One of the key benefits of investing in silver is its strong industrial demand. Silver is widely used in various industries, including electronics, solar energy, and medical applications. This industrial demand creates an additional source of market demand for silver, potentially leading to increased prices and investment value. It signifies that silver’s value is not solely dependent on its role as a store of wealth, but also on its practical applications in the modern economy.

Another advantage of investing in silver is its role as an inflation hedge. Precious metals, including silver, have historically acted as a hedge against inflation. As the value of fiat currencies can erode over time due to inflationary pressures, owning tangible assets like silver can offer protection and help preserve wealth. Silver’s inflation-hedging characteristics make it an attractive investment option for those seeking to safeguard their purchasing power.

However, it’s important to note that silver prices can be more volatile than gold. The affordability of silver means that even small changes in investor demand or economic conditions can have a significant impact on its price. Economic downturns, such as recessions, can temporarily depress silver prices as industrial demand weakens. Therefore, investors considering silver as an investment should be prepared for potential price fluctuations and carefully assess their risk tolerance.

In summary, silver offers an affordable entry point into the world of precious metal investing. Its industrial demand and inflation-hedging qualities contribute to its investment appeal. While silver prices may be more volatile, its accessibility, industrial applications, and potential as an inflation hedge make it an attractive option for investors looking to diversify their portfolios.

Pros and Cons of Investing in Silver

| Pros | Cons |

|---|---|

| 1. Affordable compared to gold | 1. Price volatility |

| 2. Strong industrial demand | 2. Influence of economic downturns |

| 3. Inflation hedge |

Platinum – The Industrial Metal

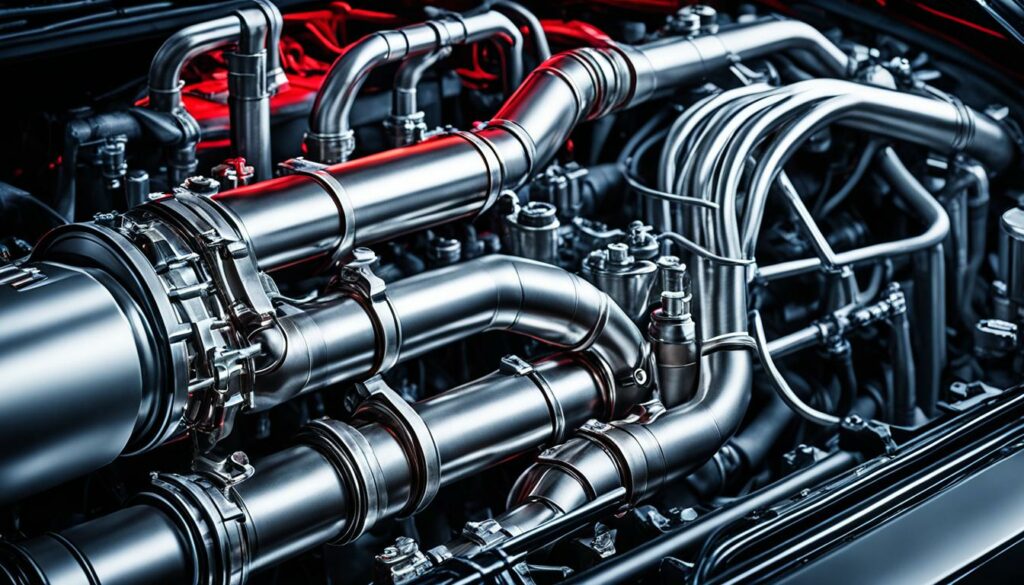

Platinum is a versatile precious metal with extensive industrial applications, making it a compelling option for investors. It is widely used in the automotive and jewelry industries, where its exceptional properties contribute to the production of high-performance catalytic converters and exquisite pieces of jewelry. This industrial demand brings inherent value to platinum as it remains an essential element in key manufacturing processes.

Rarity is another factor that sets platinum apart. It is rarer than gold and silver, which can potentially contribute to its long-term value as scarcity often drives prices upward. Throughout history, platinum’s rarity and desirability have made it a symbol of prestige and wealth.

Investing in platinum can also offer diversification benefits for precious metals portfolios beyond gold and silver. By adding platinum to an investment portfolio, investors can spread their holdings across different metals and increase their resilience against market fluctuations.

However, it is important to consider the inherent risks associated with platinum investments. Platinum prices can be highly volatile due to fluctuations in industrial demand, global economic conditions, and geopolitical factors. Additionally, investment options for platinum are more limited compared to gold and silver, which may require investors to carefully evaluate and choose suitable investment vehicles.

Industrial Use of Platinum

The utilization of platinum in various industries plays a significant role in its investment potential. Let’s take a closer look at some key industrial applications:

- Automotive Industry: Platinum is a critical component in catalytic converters, which are integral for reducing harmful emissions from vehicles. As the demand for cleaner transportation increases, so does the demand for platinum in the automotive sector.

- Jewelry Industry: Platinum’s exceptional durability and lustrous appearance make it highly prized for creating exquisite pieces of jewelry. Its hypoallergenic properties also make platinum a preferred choice for those with sensitive skin.

- Chemical Industry: Platinum serves as a catalyst in numerous chemical reactions, enabling efficient and cost-effective processes in the pharmaceutical, petroleum, and fertilizer industries, among others.

- Electronics Industry: Platinum finds application in the production of various electronic components such as hard disk drives, thermocouples, and electrodes due to its excellent electrical conductivity and resistance to corrosion.

These industrial uses contribute to the ongoing demand for platinum and its value as an investment.

Palladium – The Automotive Metal

Palladium is a highly sought-after metal in the automotive industry, particularly for its use in catalytic converters. The demand for palladium in the automotive sector is driven by stringent emissions regulations worldwide, which require vehicles to reduce harmful pollutants. As a result, the automotive sector accounts for a significant portion of the overall demand for palladium.

One of the key factors to consider when investing in palladium is the supply constraints that the market faces. Limited mining production and geopolitical factors can impact the availability of palladium, potentially leading to supply shortages. These constraints can create upward pressure on prices, making palladium an attractive investment option for those looking to capitalize on potential price appreciation.

In recent years, palladium has demonstrated impressive performance, outperforming other precious metals. This increase in demand, coupled with supply constraints, has led to significant price growth. Investors who have had exposure to palladium have benefited from its strong performance, making it an appealing asset for portfolio diversification.

However, it is important to note that investing in palladium comes with its own set of considerations. Unlike gold or silver, which have long histories as investment assets, palladium does not have as much historical data available. This lack of historical data can make it challenging to predict future price movements or gauge its long-term performance. Additionally, palladium’s price is heavily influenced by industrial demand, particularly in the automotive sector. Therefore, fluctuations in automotive production and changes in emission regulations can impact the price of palladium.

Pros and Cons of Investing in Palladium

Pros:

- Potential for price appreciation due to supply constraints

- Strong demand from the automotive industry

- Impressive recent performance

Cons:

- Limited historical data for making accurate predictions

- Reliance on industrial demand, particularly in the automotive sector

When considering an investment in palladium, investors should carefully weigh the pros and cons and assess their risk tolerance and investment goals. While palladium has shown strong performance in recent years and is driven by automotive demand, it is crucial to thoroughly research and monitor market conditions before making any investment decisions.

Advantages and Disadvantages of Investing in Precious Metals

Investing in precious metals offers numerous benefits for investors, making it a popular choice for diversifying investment portfolios. These metals not only act as a hedge against inflation but also serve as tangible assets that provide a sense of security. Moreover, the liquidity of precious metals allows investors to easily buy and sell them as needed.

Precious metals have consistently held their value over time, making them a reliable store of wealth. Their value is not subject to the same volatility as other investment options, such as stocks or currencies. This stability provides investors with a sense of reassurance, especially during economic downturns or currency fluctuations.

Additionally, the inclusion of precious metals in an investment portfolio allows for diversification. By spreading investments across different asset classes, including precious metals, investors can reduce risk and potentially increase returns. This diversification strategy helps protect against market volatility and can help achieve long-term financial goals.

However, investing in precious metals is not without its disadvantages. One potential drawback is the cost associated with storing and insuring physical metals. Unlike other investments that can be held digitally, physical metals require secure storage facilities and insurance coverage, which can add to the overall investment costs.

Furthermore, unlike stocks or bonds, precious metals do not generate income. They solely rely on price appreciation for investment returns. While the historical value stability of precious metals is a benefit, it also means that there is no income generated from these investments.

Price volatility is another consideration when investing in precious metals. While precious metal prices have generally shown resilience, there can still be fluctuations in the market due to various factors such as economic conditions, investor sentiment, and supply and demand dynamics. It is important for investors to be aware of and comfortable with the potential for price volatility.

The Advantages and Disadvantages of Investing in Precious Metals:

| Advantages | Disadvantages |

|---|---|

| – Acts as a hedge against inflation | – Storage and insurance costs |

| – Provides tangible assets | – Lack of income generation |

| – Offers liquidity | – Potential price volatility |

| – Historically holds value well | |

| – Diversifies investment portfolios |

Despite the potential disadvantages, the advantages of investing in precious metals, such as acting as a hedge against inflation, providing tangible assets, offering liquidity, and historical value stability, make them an attractive option for investors looking to diversify their portfolios and protect their wealth. It is important for investors to carefully evaluate their financial goals, risk tolerance, and investment strategy when considering precious metals as part of their overall investment plan.

Risks of Investing in Precious Metals

Investing in precious metals comes with certain risks that investors need to consider. It is important to understand these risks and evaluate them against potential benefits. Here are some key risks associated with investing in precious metals:

Price Volatility

Price volatility is a significant risk factor when it comes to investing in precious metals. The prices of gold, silver, platinum, and palladium can experience fluctuations influenced by various factors including changes in the economy, Federal Reserve policy, investor demand, mining supply, and inflation. These factors can cause significant price movements, which may impact the value of an investment.

Correlation with Stock Market

Another risk to consider is the correlation between precious metals and the stock market. While precious metals are often seen as a safe haven during times of economic uncertainty, there can be periods of correlation with stock market movements. This means that if the stock market experiences a downturn, it could also impact the value of precious metal investments.

Rise of Cryptocurrency

The rise of cryptocurrency presents a potential risk to precious metal investments. Cryptocurrencies like Bitcoin and Ethereum have gained popularity and attracted significant investor interest. As more individuals invest in cryptocurrencies, there is a possibility that demand for precious metals could decrease, diverting investor attention and funds away from gold, silver, platinum, and palladium.

It is important for investors to assess their risk tolerance and consider these factors before making investment decisions related to precious metals. Diversifying investment portfolios, considering a long-term investment horizon, and seeking professional advice can help mitigate these risks and maximize potential returns.

| Risks of Investing in Precious Metals | Description |

|---|---|

| Price Volatility | Precious metals prices can be subject to significant fluctuations influenced by various factors. |

| Correlation with Stock Market | Precious metals prices may have periods of correlation with stock market movements. |

| Rise of Cryptocurrency | Increased popularity and investment in cryptocurrencies may divert investor attention and funds away from precious metals. |

How to Invest in Precious Metals

Investing in precious metals offers a wide range of options for investors looking to diversify their portfolios and potentially capitalize on the value of these valuable assets. Whether you are interested in physical precious metals, mining company stocks, precious metals ETFs, futures contracts, or individual retirement accounts (IRAs), there are various investment avenues to explore. Each option has its own advantages and considerations, and the choice depends on your financial goals and risk tolerance.

One popular method of investing in precious metals is purchasing physical assets like gold coins or bars. This allows investors to have direct ownership of these valuable metals, providing a tangible store of value. Physical precious metals can be stored at home or in secure vaults, offering a sense of security. However, it’s important to consider storage costs and security measures when opting for this investment route.

Another way to invest in precious metals is through mining company stocks. By purchasing shares in mining companies, investors can gain exposure to the potential profits generated from the extraction and sale of precious metals. This investment option allows for indirect participation in the precious metals industry and provides the opportunity to benefit from the success of established mining companies. However, it’s crucial to research the performance and financial health of the chosen mining companies before investing.

Precious metals exchange-traded funds (ETFs) are also popular investment vehicles. These funds typically hold a diversified portfolio of precious metals, providing investors with indirect exposure to the market. Precious metals ETFs offer the advantage of liquidity and easy tradability, allowing investors to buy and sell shares throughout the trading day. They also eliminate the need for physical storage and security concerns associated with owning physical metals directly.

Comparison of Precious Metals Investment Options

| Investment Option | Advantages | Considerations |

|---|---|---|

| Physical Precious Metals | – Tangible store of value | – Storage and security costs – Limited accessibility and liquidity |

| Mining Company Stocks | – Indirect exposure to the industry – Potential profits from mining operations |

– Company-specific risks – Market volatility |

| Precious Metals ETFs | – Diversified portfolio – Easy tradability |

– Management fees – Market price premiums or discounts |

| Futures Contracts | – Potential for leveraging investments – Hedging strategies |

– High risk and volatility – Margin requirements |

| Individual Retirement Accounts (IRAs) | – Tax advantages – Potential long-term growth |

– Eligibility requirements – Limited investment options |

Futures contracts also provide opportunities for investors to engage in speculative trading of precious metals. These contracts allow investors to buy or sell a predetermined quantity of a specific precious metal at a future date and price. Futures trading can offer leveraging possibilities and serve as a hedging strategy against price fluctuations. However, it’s crucial to understand the risks associated with futures contracts, including high volatility and margin requirements.

Lastly, individual retirement accounts (IRAs) provide a tax-advantaged approach to invest in precious metals. Certain IRAs allow investors to hold physical precious metals as part of their retirement portfolio. By utilizing an IRA, investors can enjoy the potential long-term growth of precious metals while benefiting from tax advantages. However, it’s important to review eligible IRA options and understand any limitations or restrictions.

When deciding how to invest in precious metals, it’s essential to conduct thorough research, understand the risks and advantages of each investment option, and align your choices with your financial goals and risk tolerance. By carefully considering and diversifying your precious metals investments, you can potentially optimize your portfolio and make the most of the opportunities offered by these valuable assets.

Precious Metals Prices

Precious metals prices are influenced by a variety of factors, including scarcity and availability. The limited supply of precious metals, combined with their extraction process, contributes to their overall prices in the market. When these metals are scarce, their prices tend to rise due to increased demand and limited availability. Conversely, when there is an abundance of these metals, their prices may decrease.

Natural events also play a crucial role in influencing precious metals prices. Events such as natural disasters, geopolitical tensions, and disruptions in mining operations or international shipping can impact the supply chain and subsequently affect prices. For example, a major earthquake in a region rich in precious metal deposits can disrupt mining operations, leading to a decrease in supply and an increase in prices.

Additionally, economic factors, such as inflation and interest rates, can influence the demand for precious metals and consequently impact their prices. In times of economic uncertainty, investors often seek the stability and store of value that precious metals provide, driving up demand and raising prices.

To make informed investment decisions, it is crucial for investors to understand and monitor the factors that influence precious metals prices. By staying informed about scarcity and availability, as well as keeping an eye on natural events and economic developments, investors can navigate the precious metals market effectively.

Factors Influencing Precious Metals Prices

| Factors | Description |

|---|---|

| Scarcity and Availability | The limited supply and extraction process contribute to precious metals prices. Scarcity drives up prices, while availability can lead to price decreases. |

| Natural Events | Disruptions caused by natural disasters, geopolitical tensions, or mining operation interruptions can impact the supply chain and influence prices. |

| Economic Factors | Inflation, interest rates, and economic stability or uncertainty can affect the demand for precious metals and subsequently impact prices. |

Best Precious Metals to Invest in Now

When it comes to investing in precious metals, there are several options that offer attractive opportunities for investors. The best precious metals to invest in now include gold, silver, platinum, and palladium. These metals have proven to be reliable and have a track record of maintaining value over time.

If you’re interested in stocks related to precious metals, there are several companies that specialize in these metals and trade on stock exchanges. Here are some top options:

| Company | Stock Ticker |

|---|---|

| First Majestic Silver | AG |

| Franco-Nevada | FNV |

| Newmont Mining | NEM |

| Sibanye-Stillwater | SSW |

| Wheaton Precious Metals | WPM |

These companies offer exposure to the respective precious metals and can be valuable additions to a well-diversified investment portfolio. Before investing in any company, it’s important to conduct thorough research and consider factors such as financial performance, management team, and industry outlook.

Investing in precious metals, whether through physical assets or stocks, can provide a hedge against inflation and offer potential long-term growth. However, it’s crucial to consult with a financial advisor and carefully evaluate your investment goals, risk tolerance, and market conditions before making any investment decisions.

Remember, investing in precious metals should be part of a well-rounded investment strategy that considers your overall financial objectives and diversification goals.

Conclusion

Investing in precious metals is a smart strategy for diversifying and enhancing investment portfolios. Understanding the advantages, disadvantages, risks, and available options is crucial for making informed decisions. By investing in a combination of precious metals such as gold, silver, platinum, and palladium, individuals can maximize the benefits and mitigate risks.

Precious metals serve as a long-term investment tool, helping to achieve financial goals and safeguard against economic uncertainties. They offer stability, act as a hedge against inflation, and provide tangible assets that hold their value. However, thorough research and careful consideration are essential before entering the precious metals market.

To make the most of investing in precious metals, individuals should assess their risk tolerance, determine their investment goals, and carefully select the right mix of metals. Conducting comprehensive research, seeking professional advice, and staying updated on market trends can further enhance investment outcomes and increase the chances of maximizing returns.