Did you know that the total value of all the gold ever mined in the world is estimated to be around $10.6 trillion? That’s more than the combined GDP of the United Kingdom and Germany! Gold has long been considered a symbol of wealth and a safe haven asset, but how does it compare to real estate as an investment option? In this article, we will delve into the pros and cons of gold investment and real estate, exploring their unique characteristics and risks. Whether you’re a seasoned investor or just starting to build your portfolio, understanding the nuances of these two assets can help inform your investment decisions.

Key Takeaways:

- Gold and real estate are popular investment options with their own unique characteristics and risks.

- Gold is a physical precious metal that serves as a safe haven asset and can be used to hedge against inflation.

- Real estate is a property that can generate passive income through rentals.

- Both assets have their pros and cons, and it’s important to consider your investment strategy and financial goals when deciding between gold and real estate.

- Diversification and balancing your portfolio with a mix of assets can help mitigate risk and maximize returns.

Gold vs. Real Estate Comparison Overview

When considering investment options, many individuals find themselves comparing gold and real estate. While both assets have their advantages and drawbacks, they offer different characteristics that cater to various investment strategies and financial goals.

Gold: Often viewed as a safe haven during times of economic uncertainty, gold is a physical precious metal with a long history of value preservation. It is highly liquid, meaning it can be easily bought and sold, making it an attractive option for investors looking for flexibility. Gold is also known for its ability to diversify investment portfolios, as it is independent of other asset classes and can provide a hedge against inflation.

Real Estate: On the other hand, real estate offers investors the opportunity to generate reliable cash flow through rental properties. While it requires management and maintenance, real estate has the potential for long-term appreciation in value. Additionally, real estate investments can offer tax benefits and serve as a hedge against inflation, with property values typically rising alongside inflation rates.

It’s important to note that both gold and real estate come with their fair share of risks. Gold prices can be influenced by economic and geopolitical factors, while real estate values are subject to market conditions and fluctuations. Understanding these risks and conducting thorough research is essential when considering either investment option.

Ultimately, the decision between gold and real estate will depend on an individual’s investment strategy, risk tolerance, and financial objectives. Some investors may prefer the tangible nature and liquidity of gold, while others may be drawn to the income potential and long-term appreciation offered by real estate.

Remember, diversification is key when building an investment portfolio. Balancing different asset classes, including both gold and real estate, can help mitigate risk and maximize returns over the long term.

| Gold Investment | Real Estate Investment |

|---|---|

| Physical precious metal | Property ownership |

| Highly liquid | Requires management and maintenance |

| Portfolio diversifier | Potential for long-term appreciation |

| Hedge against inflation | Reliable cash flow through rentals |

Why Invest in Gold: Pros & Cons

Investing in gold can offer several advantages, but it’s important to weigh the pros and cons before making any decisions. The following are the key benefits and drawbacks associated with gold investment:

Pros of Gold Investment

- Store of Value: Gold has been valued for centuries and has maintained its worth over time. Its limited supply and universal desirability make it a reliable store of value.

- Hedge Against Inflation: Gold is often viewed as a hedge against inflation. When the value of fiat currencies declines, gold tends to hold its value, providing a reliable means of preserving purchasing power.

- Diversification: Investing in gold can effectively diversify your investment portfolio. It is a non-correlated asset, meaning its value can move independently of other assets like stocks and bonds, which can help protect your overall portfolio from market volatility.

- Various Investment Options: Gold investment offers several avenues to investors. You can choose to invest in physical gold assets, such as coins or bars, or opt for gold-backed exchange-traded funds (ETFs) or gold mining stocks, providing flexibility to suit your investment goals and preferences.

Cons of Gold Investment

- Additional Costs: Investing in physical gold or gold-related assets may incur additional expenses such as insurance and storage costs. These costs can impact overall investment returns.

- Potential for Low Returns: While gold is a relatively safe investment, it is not known for delivering high returns in the short term. Its value tends to appreciate gradually over time, making it more suitable for long-term investors looking to preserve wealth rather than generate substantial immediate gains.

- Capital Gains Tax: Depending on the jurisdiction, gains from selling gold can be subject to capital gains tax. It’s crucial to consider the tax implications of gold investment to accurately assess its potential returns.

Considering these pros and cons, gold investment can be a valuable addition to a diversified portfolio, serving as a means of wealth preservation and a hedge against inflation. However, it’s important to carefully assess your financial goals, risk tolerance, and overall investment strategy before allocating funds to gold.

Why Invest in Real Estate: Pros & Cons

Investing in real estate offers a range of benefits and considerations for investors. It provides the potential for rental income and property appreciation, making it an attractive long-term investment.

One of the main advantages of investing in real estate is the opportunity to earn a steady stream of rental income. By purchasing properties and leasing them to tenants, investors can generate regular cash flow that can supplement their income or be reinvested for further growth.

Real estate also has the potential for property appreciation over time. As demand for housing increases and properties become scarcer, the value of real estate can rise, allowing investors to build equity and potentially earn substantial profits when selling their properties.

Additionally, real estate offers tax benefits through deductions. Investors can deduct various expenses, such as mortgage interest, property taxes, and maintenance costs, which can help lower their taxable income and increase their overall returns.

Furthermore, real estate can serve as an effective inflation hedge. As inflation erodes the purchasing power of money, real estate values tend to rise in line with inflation rates. By investing in real estate, investors can protect their wealth and preserve the value of their assets.

However, investing in real estate also comes with some considerations. One of the challenges is the ongoing maintenance of properties. Investors are responsible for repairs, renovations, and general upkeep, which can require time, effort, and financial resources.

“Real estate can offer attractive returns, but it’s essential to carefully consider the potential risks and market fluctuations,” warns John Smith, a real estate investment expert.

Another factor to consider is the illiquidity of real estate investments. Unlike stocks or bonds, real estate cannot be easily bought or sold. It can take time and effort to find buyers or renters and complete the necessary legal processes, limiting the flexibility of real estate investments.

Lastly, investing in real estate often requires a significant upfront investment. Property purchases typically involve substantial down payments and additional expenses, such as closing costs and property inspections. This large capital outlay may not be feasible for all investors.

Despite these considerations, many investors find real estate to be a rewarding and profitable investment strategy. By carefully weighing the pros and cons, considering their financial goals, and conducting thorough market research, investors can make informed decisions and maximize the benefits of real estate investment.

Pros and Cons of Investing in Real Estate

| Pros | Cons |

|---|---|

| ● Potential for rental income | ● Ongoing maintenance requirements |

| ● Property appreciation | ● Illiquidity of real estate investments |

| ● Tax benefits through deductions | ● Significant upfront investment |

| ● Inflation hedge |

Land vs. Gold as Investments

When considering investment options, both land and gold offer unique opportunities for appreciation in value over time. Land, with its utility as a resource for building or agriculture, has inherent value that can increase as development or demand rises. On the other hand, gold, with its various industrial applications and limited supply, presents an opportunity for value appreciation based on market demand and scarcity.

Land investment is driven by its potential uses and can provide different avenues for profit. A piece of land can be developed into residential, commercial, or industrial properties, generating rental income or capital gains. Agricultural land can be leased out for farming purposes, yielding steady returns. The value of land is influenced by factors such as location, infrastructure development, and zoning regulations.

Gold is a tangible asset that has been valued throughout history for its aesthetic and monetary properties. It is used in various industries, including jewelry, technology, and finance. As global economic conditions fluctuate, the demand for gold can increase as investors seek a safe haven in times of uncertainty. The limited supply of gold makes it a finite resource, adding to its value as an investment.

“Land is the basis of all wealth.”

– Adam Smith

Both land and gold offer reliable investment opportunities, but they come with their own sets of risks and considerations. Land investments require careful analysis of market conditions, legal complexities, and potential costs associated with development or maintenance. Gold investments, while highly liquid, may be subject to price volatility and the fluctuating demand in the international market.

Land vs. Gold: A Comparative Analysis

| Factors | Land | Gold |

|---|---|---|

| Potential for Appreciation | Can increase in value based on development potential and demand. | Value can rise due to scarcity and global economic conditions. |

| Income Generation | Can provide rental income or profits from property sales. | Does not generate income as gold is a non-yielding asset. |

| Liquidity | Real estate can be relatively illiquid, requiring time to sell. | Gold is highly liquid and can be easily bought or sold. |

| Market Factors | Dependent on location, infrastructure, and zoning regulations. | Prices influenced by global economic conditions and demand. |

| Risks | Market fluctuations, legal issues, development costs. | Price volatility, global economic conditions, geopolitical factors. |

Before investing in land or gold, it’s crucial to thoroughly research and consider your investment goals, risk tolerance, and market conditions. Consulting with a financial advisor can provide valuable insights and guidance to make informed decisions based on your individual circumstances.

China Woes and Russian Politics

The Chinese demand for UK properties has been a significant driving force in the real estate market, contributing to its growth and stability. However, recent economic challenges in China have resulted in a decline in the demand for UK properties. As cracks appear in the Chinese economy, investors are becoming more cautious, impacting the market dynamics.

In addition to the Chinese’s reduced enthusiasm in the UK market, political tensions with Russia have further affected the real estate landscape. Russian buyers, who have traditionally been active participants in the UK market, have withdrawn due to geopolitical uncertainties. This withdrawal has introduced a new element of risk and uncertainty to the market.

These developments in China and Russia have the potential to significantly impact the demand and value of real estate investments. The reduction in Chinese demand and the withdrawal of Russian buyers can lead to a decrease in property prices and potentially affect the overall profitability of real estate investments.

It is essential for investors to closely monitor these factors and their implications on the UK property market. Understanding the trends and shifts in demand from international buyers, such as the Chinese and Russians, is crucial for making informed investment decisions in the real estate sector.

New Legislation Around Greenbelt Land

New legislation on greenbelt land can have a significant impact on property investment. The limited availability of space for new houses in these areas often drives up property values, making real estate a stable long-term investment. Investors tend to see greenbelt land as an attractive option due to its scarcity and potential for future development. The value of properties located in greenbelt areas can appreciate over time, providing excellent returns on investment.

However, it is essential to consider the potential drawbacks that come with new legislation around greenbelt land. Increased regulations can hamper the demand for properties within these areas, as certain restrictions and limitations may be imposed on development. This could affect the supply and value of real estate investments in greenbelt regions.

Investors should closely monitor any new legislation surrounding greenbelt land, as it can have implications for both current and future property investments. Staying informed about the latest developments in this area can help investors make well-informed decisions and adjust their investment strategies accordingly.

Example:

“The new legislation around greenbelt land presents both opportunities and challenges for property investors. While the limited availability of space can drive up property values, increased regulations may restrict development and potentially impact the demand and value of properties in greenbelt areas. It is crucial for investors to stay informed and adapt their strategies to navigate these changes effectively.”

Stamp Duty Rise on Buy-to-Lets

The rise in stamp duty on buy-to-let properties has had a significant impact on property investment in recent years. Stamp duty is a tax levied on the purchase of properties, and the increase in rates for buy-to-let properties has made it more expensive for investors to enter the market or expand their property portfolios.

The higher upfront tax burdens associated with the stamp duty rise have deterred many potential investors from entering the buy-to-let market. This has resulted in a decrease in demand for rental properties, as the additional costs reduce the profitability of these investments. With higher stamp duty costs, investors may be less willing to take on the financial commitment of purchasing and maintaining a rental property.

The impact of the stamp duty rise on property investment extends beyond the initial purchase. Higher tax burdens can make it more challenging for investors to achieve the desired return on investment from rental income. With increased costs, rental prices may need to be raised to offset the higher stamp duty expenses, potentially making properties less competitive in the rental market.

Furthermore, the stamp duty rise on buy-to-let properties can also have implications for the overall profitability of real estate investments. The increased tax burden reduces the potential capital gains that investors can realize when selling their properties. This may discourage investors from considering real estate as a viable investment option, as the potential returns may no longer justify the risks and expenses involved.

Overall, the stamp duty rise on buy-to-let properties has had a significant impact on property investment, discouraging potential investors and reducing the profitability of rental properties. Higher tax burdens have made it more challenging for investors to enter the market and achieve the desired return on investment. These changes highlight the importance of considering the tax implications and costs associated with property investments before making any financial commitments.

| Type of Property | Stamp Duty Rate (Before Increase) | Stamp Duty Rate (After Increase) |

|---|---|---|

| Main Residence | 0% | 0% |

| Buy-to-Let Property | 2% on the first £125,000 5% on the portion between £125,001 – £250,000 8% on the portion between £250,001 – £925,000 13% on the portion between £925,001 – £1.5 million 15% on the portion above £1.5 million |

3% on the first £125,000 8% on the portion between £125,001 – £250,000 13% on the portion between £250,001 – £925,000 15% on the portion between £925,001 – £1.5 million 15% on the portion above £1.5 million |

Difficult to Raise Money

Obtaining buy-to-let mortgages has become increasingly challenging for investors due to stricter regulations imposed by banks. The difficulty of getting buy-to-let mortgages can hinder investors from securing the necessary financing to enter or expand their real estate portfolios. This poses a significant hurdle for those looking to capitalize on the potential returns offered by rental properties.

Furthermore, reduced tax breaks for buy-to-let investors have diminished the attractiveness of this asset class. The tax changes have significantly curtailed the potential profits that investors can derive from their buy-to-let properties. As a result, many investors are reevaluating the viability of buy-to-let investments and exploring alternative avenues for generating rental income.

These challenges related to getting buy-to-let mortgages and the diminished tax benefits have a direct impact on the accessibility and profitability of real estate investments. Investors must navigate tighter lending criteria and evaluate the financial feasibility of their investments considering the reduced tax advantages.

Struggles facing investors

The revised lending standards implemented by banks have created difficulties for investors looking to secure buy-to-let mortgages. Stringent affordability assessments and increased deposit requirements make it harder for individuals to obtain the necessary financing to purchase rental properties. This has restricted the pool of potential investors and limited the overall growth of the buy-to-let market.

Furthermore, the reduced tax breaks for buy-to-let investors have resulted in higher tax liabilities and decreased profits. The changes introduced by tax authorities have made it less attractive for investors to engage in buy-to-let investments, eroding the incentives to become a landlord and own rental properties.

“The combination of stricter lending criteria and reduced tax breaks has made it more challenging for investors to pursue buy-to-let investments. These hurdles can deter potential investors and impact the overall performance of the real estate market.”

Alternative investment options

As investors face difficulties in obtaining buy-to-let mortgages and managing the reduced tax benefits, they are increasingly considering alternative investment options. Some investors are exploring opportunities in other sectors of the real estate market, such as commercial properties or real estate investment trusts (REITs), which offer potential benefits and diversification.

Additionally, investors are exploring alternative asset classes that may provide comparable or higher returns with fewer barriers. These asset classes could include stocks, bonds, or even gold investments. By diversifying their portfolios, investors can mitigate some of the risks associated with real estate investments and find more accessible avenues for achieving their financial goals.

| Investment Options | Pros | Cons |

|---|---|---|

| Buy-to-let Real Estate | – Potential rental income – Property appreciation – Inflation hedge |

– Difficulty obtaining mortgages – Reduced tax breaks – Property management and maintenance – Market fluctuations |

| Commercial Real Estate | – Higher rental income potential – Diversification of real estate portfolio – Market-specific advantages |

– Higher investment requirements – Market volatility and risk – Property management challenges |

| Real Estate Investment Trusts (REITs) | – Diversification through pooled investments – Professional management – Potential dividend income |

– Market volatility – Limited control over individual investments – Possible changes in legislation |

| Stocks | – Liquidity and accessibility – Potential for significant returns – Different sectors and industries to choose from |

– Market volatility and risk – Reliance on stock market performance – Sentiment and news impacts |

| Bonds | – Fixed-income potential – Lower volatility compared to stocks – Diversification from real estate |

– Lower potential for capital growth – Interest rate changes affecting bond values – Credit and default risks |

| Gold Investments | – Hedge against inflation and uncertainty – Portable and liquid asset – Preservation of wealth |

– Limited income potential – Value fluctuations – Storage and security costs |

Liquidity and Accessibility

When it comes to the accessibility of investments, gold and real estate present contrasting options. Gold, being a highly liquid asset, offers investors the advantage of easily buying and selling. Its value can be readily realized without the need for complex processes or lengthy transactions.

On the other hand, real estate involves a more intricate buying and selling process. Acquiring a property often requires careful consideration, negotiation, and legal procedures. Financing may also be necessary, further extending the timeline for completing a transaction. As a result, real estate investments demand more resources and familiarity with the market.

For novice investors or those seeking a simple and straightforward entry into the investment world, gold provides greater accessibility. Its ease of buying and selling allows individuals to quickly participate and take advantage of potential opportunities.

However, it is important to note that real estate offers its own unique benefits, such as potential long-term appreciation and the ability to generate rental income. While the process may be more involved, the potential rewards can be significant for those willing to navigate the real estate market.

To summarize, gold’s liquidity and accessibility make it an attractive investment option for individuals seeking simplicity and flexibility. Real estate, while requiring more resources and market knowledge, offers the potential for long-term wealth accumulation and income generation.

Investors should carefully consider their financial goals, risk tolerance, and investment strategy when deciding between gold and real estate.

Benefits of Gold’s Accessibility

Gold’s accessibility enables investors to capitalize on market opportunities swiftly.

“The ease of buying and selling gold makes it an attractive option for investors looking to quickly adjust their portfolio or take advantage of market fluctuations.” – Expert Analyst

Considerations for Real Estate Accessibility

Real estate’s accessibility may be more challenging due to the complexities of the buying and selling process.

“Real estate investments require careful research, property inspections, and various legal procedures, which may deter some investors seeking more straightforward investment options.” – Real Estate Advisor

Investment Accessibility Comparison: Gold vs. Real Estate

| Factors | Gold | Real Estate |

|---|---|---|

| Liquidity | High | Lower |

| Buying and Selling Process | Straightforward | Complex |

| Market Knowledge Requirement | Low | High |

| Flexibility | High | Lower |

| Potential Returns | Varies | Potentially Higher |

Diversification and Risk Management

Both gold and real estate offer unique opportunities for diversifying your investment portfolio and managing risk. Diversification in gold and real estate can help balance out the overall volatility of your investment portfolio by including assets from different asset classes.

Gold is often viewed as a relatively low-risk investment due to its intrinsic value and historical stability. It has been considered a safe haven asset, particularly during times of economic uncertainty. The price of gold is influenced by a variety of factors such as supply and demand dynamics, geopolitical tensions, and macroeconomic trends. By including gold in your investment portfolio, you can add a low-risk asset that can potentially provide stability and act as a hedge against inflation.

Real estate investments, on the other hand, carry more inherent risk compared to gold. The value of real estate can be subject to fluctuations based on factors such as the overall health of the economy, local housing market conditions, and interest rates. However, real estate investments have the potential to provide significant returns through rental income and property appreciation. Additionally, real estate can be an effective long-term investment strategy when managed properly.

It’s important to note that the returns on real estate investments can be influenced by various factors, including the actions of the investor and the prevailing market conditions. Market conditions such as changes in interest rates, supply and demand dynamics, and economic factors can impact the performance of real estate investments.

Benefits of Diversification in Gold and Real Estate

When considering your investment strategy, it’s essential to embrace diversification in gold and real estate. By holding both assets, you can potentially mitigate risk and take advantage of the unique characteristics of each investment class. Gold provides a hedge against inflation and acts as a safe haven during economic downturns, while real estate offers the potential for long-term appreciation and rental income.

| Benefits of Gold | Benefits of Real Estate |

|---|---|

| Acts as a hedge against inflation | Potential for rental income |

| Preserves purchasing power | Potential for property appreciation |

| Uncorrelated with other asset classes | Tax advantages through deductions |

| Highly liquid and easily traded | Inflation hedge |

By diversifying your investment portfolio with both gold and real estate, you can potentially reduce the overall risk and increase the potential for consistent returns. It’s important to assess your risk tolerance, financial goals, and investment horizon when determining the optimal allocation between these two asset classes.

Ultimately, diversification in gold and real estate can help you build a robust and balanced investment portfolio that can weather different market conditions and generate returns over the long term.

Tangibility

Gold and real estate are physical assets that provide investors with a tangible presence in their investment portfolios. Both offer unique benefits and considerations when it comes to the tangibility of their assets.

When investing in gold, investors have the opportunity to physically possess the precious metal. Whether it is gold bars, coins, or jewelry, these tangible assets can be kept in a controlled environment such as a safe or a vault. The ability to physically hold and store gold adds a sense of security and control to the investment.

On the other hand, real estate investments offer investors the opportunity to own a physical property. Whether it is a residential home, commercial building, or land, real estate provides investors with a tangible asset that they can see and touch. This physical presence can create a sense of ownership and pride for investors.

It is worth noting that the method of investing can affect the level of control and tangibility in real estate investments. For example, investing in real estate through Real Estate Investment Trusts (REITs) or Real Estate Crowdfunding platforms may provide a more indirect form of ownership, reducing the tangibility of the asset. However, direct property ownership allows investors to have a more hands-on approach and physical control over their investment.

Ultimately, the tangibility of gold and real estate adds a unique dimension to these investments, giving investors a sense of ownership and control over physical assets, in contrast to other forms of investments that are purely digital or abstract.

| Gold | Real Estate |

|---|---|

| Physical precious metal | Physical property |

| Possibility of owning gold bars, coins, or jewelry | Possibility of owning residential homes, commercial buildings, or land |

| Can be stored in a controlled environment | Provides a sense of physical ownership and control |

| Enhances the sense of security and tangibility in a portfolio | Creates a sense of ownership and pride for investors |

| Method of investing can affect the level of tangibility | Direct ownership provides a more tangible experience |

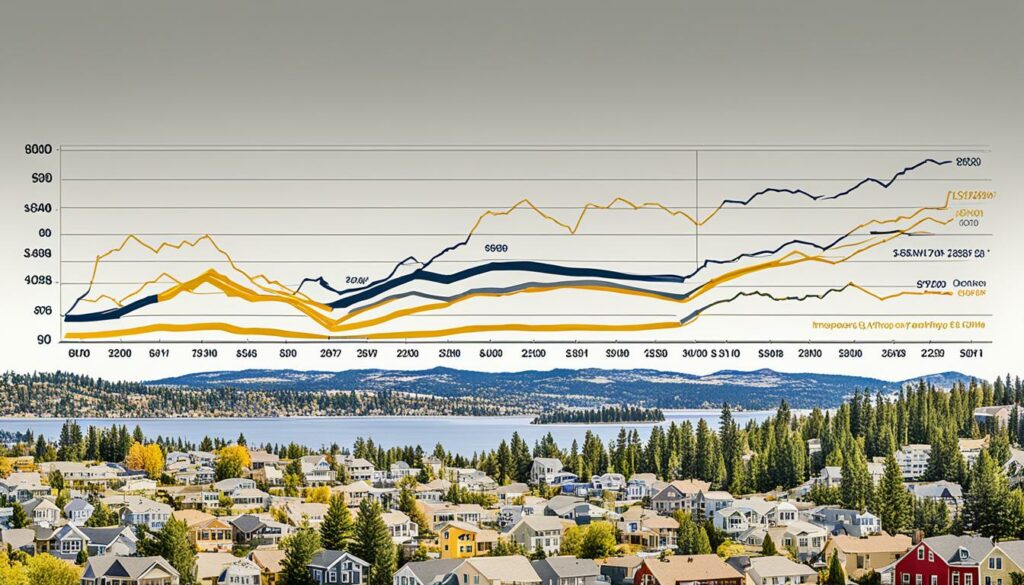

Historical Performance Between the Two Investments

When it comes to investing, understanding the historical performance of different assets is crucial. In the case of gold and real estate, their past performance offers valuable insights into their long-term average returns.

Gold has demonstrated a steady increase in value over time. As a safe haven asset, it has served as a store of value, especially during periods of economic uncertainty. However, gold typically provides relatively low returns compared to other investments. Its value tends to appreciate gradually rather than experiencing drastic fluctuations.

Real estate, on the other hand, has shown a more varied performance. Its values can fluctuate significantly depending on economic conditions and the housing market. While real estate investments can offer higher returns compared to gold, they also carry a higher level of risk due to market volatility.

“Investors should keep in mind that past performance does not guarantee future results.”

It is essential to note that historical performance should not be the sole determining factor when making investment decisions. Factors such as current market conditions, economic outlook, and individual investment goals should also be considered.

Table: A Comparison of Historical Performance

| Asset | Historical Performance |

|---|---|

| Gold | Steady increase in value over time, but relatively lower returns |

| Real Estate | Varied performance, influenced by economic conditions and housing market trends. Higher returns but higher risk compared to gold |

While gold and real estate have different historical performance trends, both assets can play a role in a well-diversified investment portfolio. The choice between these two investments depends on individual preferences, risk tolerance, and long-term financial goals.

How Are Gold and Real Estate Used as an Inflation Hedge?

Gold and real estate are commonly utilized as effective measures against the impact of inflation on investments. During periods of inflation, investors often seek refuge in gold due to its historical stability and tangible value. The price of gold tends to rise in response to inflation, making it an attractive hedge against the devaluation of currency.

Real estate, on the other hand, also serves as an inflation hedge. As the general price level rises, the value of real estate properties tends to appreciate. This appreciation can occur in two ways—either through increased rental income or the growth of the property’s market value. In both cases, real estate investors benefit from the ability to protect their investments from the erosive effects of inflation.

Investing in gold and real estate allows individuals to preserve and potentially grow their wealth while mitigating the impact of inflation on their financial portfolios. These assets present attractive alternatives to traditional investments that may suffer from significant losses in purchasing power during periods of high inflation.

Gold and real estate offer unique advantages as inflation hedges. Gold possesses intrinsic value and has been used as a medium of exchange for centuries, making it a reliable asset in times of economic uncertainty. Its liquidity ensures that investors can readily convert their holdings into cash if needed.

Real estate, on the other hand, allows investors to benefit from rental income, which often increases with inflation. Additionally, real estate investments can provide long-term appreciation in value, making them an attractive option for preserving wealth over time.

Comparing Gold and Real Estate as Inflation Hedges

While both gold and real estate can act as inflation hedges, they have distinct characteristics that may influence an investor’s decision.

| Gold | Real Estate |

|---|---|

| High liquidity | Lower liquidity compared to gold |

| Portable and easily tradable | Requires management and may have limited geographical scope |

| Relatively stable price during economic uncertainty | Values tend to fluctuate with market conditions |

| No ongoing maintenance costs | Requires maintenance and occasional expenses |

No investment is without risks. Gold and real estate investments are subject to market fluctuations and other economic factors that could impact their value. It is essential for investors to carefully consider their own risk tolerance, investment goals, and financial circumstances before deciding to allocate significant portions of their portfolios to these assets.

Ultimately, diversification is key when building a resilient investment portfolio. Combining gold and real estate with other asset classes can help to spread risk and enhance long-term returns.

Conclusion

After evaluating the pros and cons of gold and real estate, it is clear that both options have their own unique advantages and disadvantages. When making an investment decision, it is crucial to consider your investment strategy, financial goals, and risk tolerance.

Diversification is key to managing risk and maximizing returns. By creating a well-balanced portfolio that includes a mix of assets, you can mitigate potential risks associated with either gold or real estate. This strategy allows you to benefit from the stability of gold and the potential for rental income and property appreciation with real estate.

In the end, there is no one-size-fits-all investment choice for everyone. The decision between gold and real estate ultimately depends on your individual circumstances and preferences. By carefully assessing your financial situation and goals, you can make an informed choice that aligns with your long-term investment objectives.