Transparency in policies and fees, reputation, security of investments, personalized support, and clear storage options are crucial when choosing a trustworthy gold IRA custodian. Having a clear fee structure and open communication helps build trust. Positive reviews and a good reputation in the industry are indicators of reliability. It is essential to have secure storage in IRS-approved depositories. Personalized services and compliance with IRS regulations improve the overall client experience. It is important for custodians to offer segregated or allocated storage options. These factors are key in establishing trust and confidence in selecting a custodian that aligns with your investment objectives. Take the time to research further in order to make an informed decision.

Key Takeaways

- Transparent fee structures and policies build trust.

- Positive customer feedback and solid reputation indicate reliability.

- Secure storage in IRS-approved depositories is crucial.

- Personalized support for individual client needs.

- Clear information on segregated or allocated storage options.

Transparency in Policies and Fees

Ensuring transparency in policies and fees is essential for gold IRA custodians to establish trust with their clients and uphold ethical standards in their operations. Clear fee structures and detailed disclosures on fees, charges, and potential risks are vital components of building trust with investors. By providing clients with transparent policies, custodians enable them to fully understand the rules and guidelines governing their gold IRAs. Open communication about fees and policies fosters a positive client-custodian relationship based on honesty and integrity.

Ethical practices, including transparent policies and fees, demonstrate a custodian's commitment to client education and empowerment. When custodians openly disclose all relevant information regarding fees and charges, investors can make informed decisions without fear of hidden costs or surprises. This level of transparency not only builds trust but also indicates a custodian's dedication to ethical conduct in their dealings with clients. Ultimately, clear fee structures and transparent policies play a vital role in establishing a positive and mutually beneficial relationship between gold IRA custodians and their clients.

Reputation and Customer Feedback

Building a solid reputation in the gold IRA industry relies heavily on positive customer reviews and ratings as key indicators of a custodian's reliability and integrity. Trustworthy custodians are known for their solid industry reputation, built on transparent practices, fair dealings, and ethical conduct.

Evaluating a custodian's reputation can be done through tools like Better Business Bureau (BBB) ratings and online feedback from customers. Positive reviews not only reflect customer satisfaction but also demonstrate the custodian's commitment to providing quality services. Custodians that prioritize maintaining a positive reputation tend to be more transparent in their practices, ensuring that clients feel secure in their investments.

A reputable custodian understands that their industry reputation is essential and works towards upholding it through trustworthy and ethical behavior. By valuing customer feedback, custodians can continuously improve their services and strengthen their reputation in the competitive gold IRA market.

Security of Investments

To uphold the trust established through positive customer feedback and reputation, gold IRA custodians prioritize the security of investments by guaranteeing the safe storage of physical precious metals in IRS-approved depositories. These third-party depositories play an essential role in safeguarding assets against theft, damage, and loss, providing investors with an additional layer of security. It is essential for precious metals held in IRA accounts to adhere to strict IRS guidelines regarding purity and quality to maintain the integrity of the investment.

Home storage of precious metals within IRA accounts is prohibited by the IRS, emphasizing the need for proper custodial oversight and secure storage practices. The partnership between custodians and depositories creates a regulated environment that ensures compliance with IRS regulations and enhances the security of investors' assets. By operating within these guidelines and maintaining secure storage facilities, gold IRA custodians offer investors peace of mind and confidence in the safety of their investments.

Personalized Support and Services

Reputable gold IRA custodians consistently tailor personalized investment strategies to meet the specific needs of individual clients. This personalized support includes dedicated assistance throughout the setup, funding, and transaction processes of gold IRAs.

Custodians prioritize compliance with IRS regulations, keeping clients informed about important aspects such as Required Minimum Distributions. Additionally, they provide services like asset titling, issuing quarterly statements, and offering guidance on buy-sell instructions.

Clients can rely on these custodians for thorough support, including help with distribution, transfer, and rollover instructions. By prioritizing client satisfaction, these custodians aim to build trust by offering a high level of service and guidance.

This commitment to personalized support and services is essential in helping clients navigate the complexities of gold IRA investments effectively.

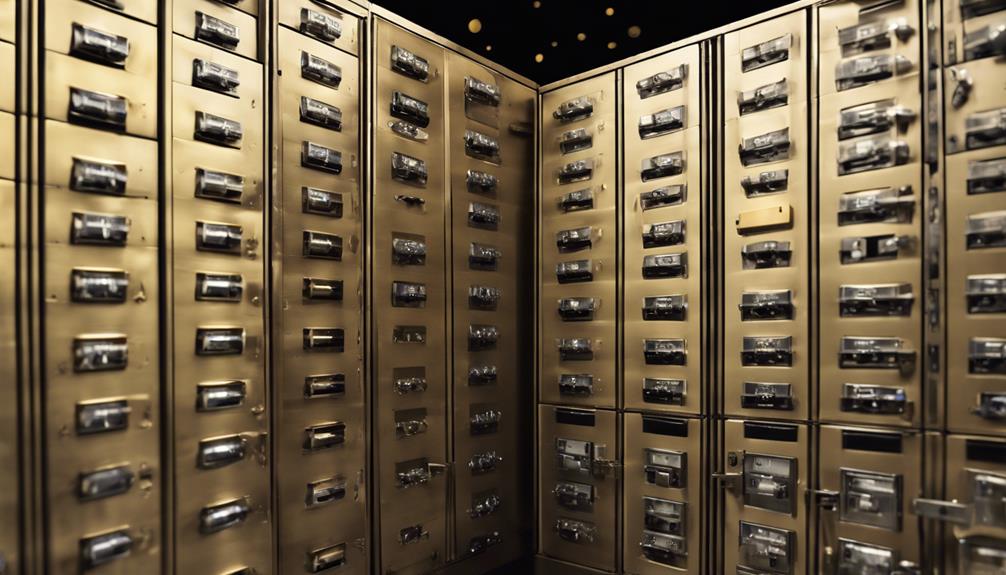

Clear Information on Storage Options

With a focus on guaranteeing the secure storage of clients' physical gold assets, Gold IRA custodians provide clear information on storage options at approved third-party depositories. When it comes to holding precious metals in a Gold IRA, compliance with IRS regulations mandates that these assets be stored off-site.

To meet this requirement, custodians collaborate with secure storage facilities to safeguard the physical gold assets of their clients. The storage options offered typically include segregated or allocated storage, catering to individual or shared holdings. Segregated storage ensures that each client's metals are kept separate, while allocated storage designates specific bars or coins to each investor without physical separation.

Frequently Asked Questions

How to Choose a Gold IRA Custodian?

When selecting a Gold IRA custodian, consider factors like reputation, fees, and services offered. Look for custodians with a solid track record, transparent fee structures, and a range of investment options. Validate they comply with IRS regulations and provide secure storage for precious metals.

Researching customer reviews and seeking recommendations can help in making an informed decision. Ultimately, choosing a reputable and trustworthy custodian is essential for managing your Gold IRA effectively.

How Do I Choose an IRA Custodian?

When choosing an IRA custodian, consider factors like reputation, accreditation, fee structure, customer service, experience, and investment options. Research custodians thoroughly, checking for industry standing, certifications, and customer feedback.

Compare fee schedules for transparency and competitiveness. Evaluate customer service quality through responsiveness and professionalism.

Look for custodians with a solid track record, long business history, and a diverse range of investment opportunities to meet your financial goals effectively.

Are Gold Backed IRAS Safe?

Gold-backed IRAs are generally considered safe due to the tangible asset backing the investment. The physical gold held in a gold-backed IRA provides security against market fluctuations and acts as a hedge against economic uncertainty.

Investors value the stability and historical performance of gold, which offers a sense of security during turbulent times. The intrinsic value and stability of gold as a precious metal contribute to the safety of gold-backed IRAs.

What Is a Gold Custodian?

A gold custodian is a financial institution responsible for safeguarding physical gold assets within a Gold IRA. They manage transactions like buying, selling, and transferring gold investments in adherence to IRS regulations.

While not offering investment advice, custodians focus on securely storing and managing clients' precious metals. They maintain accurate records, issue required notices, and handle IRS reporting for Gold IRAs.

Custodians play a key role in managing self-directed retirement accounts containing physical gold.

What Criteria Should I Use to Choose a Gold IRA Custodian?

When managing your gold IRA, it’s essential to select a reputable custodian. Look for a company with a solid track record, transparent fees, and experience in handling precious metals. Research their customer reviews and ratings, and ensure they offer secure storage options for your investments.

Conclusion

To wrap up, when choosing a gold IRA custodian, it is crucial to prioritize transparency, reputation, security, personalized support, and clear information on storage options. These aspects can greatly impact the success and safety of your investments.

Keep in mind, selecting the right custodian is akin to finding a needle in a haystack – it may require time and effort, but the benefits are priceless.