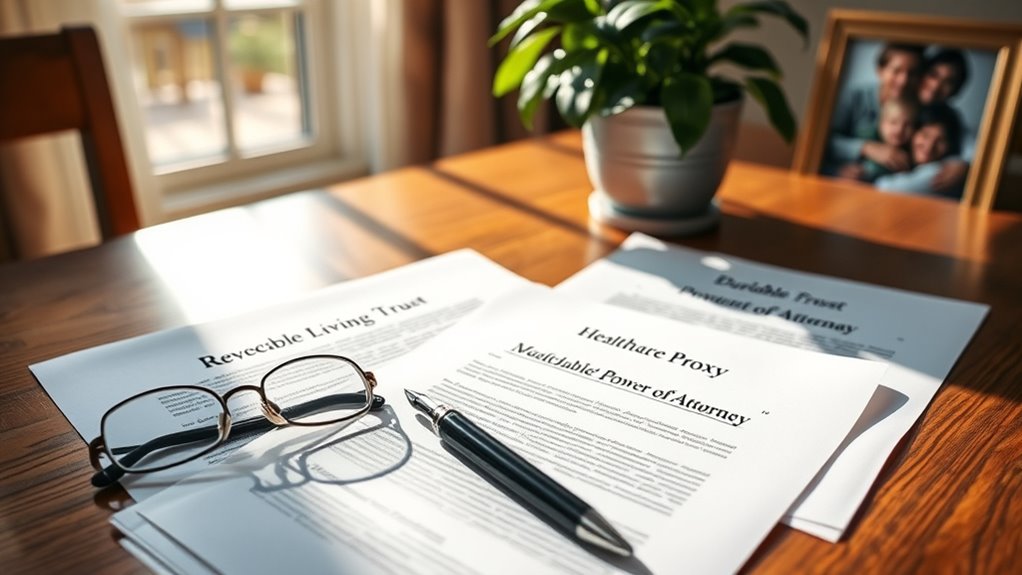

Estate planning’s essential for retirees to guarantee your wishes are honored and loved ones are protected. Key documents include a Last Will and Testament, Financial Power of Attorney, Healthcare Power of Attorney, and Advance Directives. A Revocable Living Trust can also help avoid probate and keep your affairs private. Don’t forget to maintain asset and liability lists, and regularly update your documents to reflect changes in your life. Learn more about these critical components of estate planning.

Key Takeaways

- A Last Will and Testament outlines asset distribution, appoints guardians for minors, and prevents state laws from dictating asset allocation.

- A Financial Power of Attorney allows a trusted person to manage finances and ensure financial stability during health crises.

- A Healthcare Power of Attorney designates someone to make medical decisions on your behalf if you become incapacitated.

- Advance directives and living wills clarify your treatment preferences, guiding family and healthcare providers during critical health situations.

- Regular updates to estate planning documents are essential to reflect changes in personal circumstances and legal requirements.

DocSafe 5200°F Document Organizer with Lock, Upgraded Heat Insulated Fireproof&Water-Resistant Box 8 Layers File Organizer, Portable Home Travel Safe Storage for Important Documents and More

5200°F Fireproof&Water-resistant safe: The Upgraded important document organizer is made of thickened silicone coated fireproof cotton material and...

As an affiliate, we earn on qualifying purchases.

Understanding the Last Will and Testament

Understanding the Last Will and Testament is essential for ensuring your assets are distributed according to your wishes after you pass away. Your will defines how your belongings will be allocated and names an executor to carry out your wishes. It’s also vital for appointing guardians if you have minor children or dependents. Without a will, state laws will dictate asset distribution, often leading to delays and outcomes you wouldn’t desire. Remember, a will only covers probate assets; non-probate assets pass directly through beneficiary designations. It’s wise to review and update your will regularly to reflect any changes in your family or financial situation. Additionally, consider consulting an attorney to ensure your will complies with necessary legal requirements to avoid future disputes. Taking these steps will help you achieve peace of mind regarding your legacy.

SentrySafe Black Fireproof and Waterproof Safe, File Folder and Document Box with Key Lock, Ex. 14.3 x 15.5 x 13.5 inches, HD4100

FIREPROOF: Safe is UL Classified to endure 1/2 hour at 1550°F and keep interior temperatures safe for irreplaceable...

As an affiliate, we earn on qualifying purchases.

Importance of Financial Power of Attorney

Having a Financial Power of Attorney is essential for everyone, as it guarantees that someone you trust can manage your financial affairs if you become incapacitated. This document allows your agent to pay bills, manage investments, and handle taxes, ensuring your financial stability during health crises. Choosing a reliable agent is vital, as they’ll make significant decisions on your behalf.

| Key Responsibilities | Agent’s Role | Potential Benefits |

|---|---|---|

| Pay bills | Financial management | Prevents late fees |

| Manage investments | Asset protection | Maintains portfolio growth |

| Handle taxes | Tax compliance | Avoids penalties |

Having this document in place provides peace of mind, knowing that your finances are in capable hands when you can’t manage them yourself. Additionally, selecting an agent who understands the importance of financial stability can help ensure that your resources are protected during challenging times.

Fireproof Document Box - Hard-Shell Design Waterproof & Fireproof Document Safe with Lock, Fire Proof File Box for Documents, Certificates, Laptops, Passports, Black

Ultimate Fireproof & Water Box - The fireproof file box features a hard-shell design constructed from premium flame-retardant,...

As an affiliate, we earn on qualifying purchases.

Healthcare Power of Attorney: Making Medical Decisions

When it comes to your healthcare decisions, designating a trusted individual as your healthcare power of attorney is vital. This role ensures that someone you trust makes important medical choices on your behalf, reducing the chances of family conflicts during emergencies. Clear decision-making authority can provide peace of mind for both you and your loved ones. Additionally, understanding the importance of full sustained attention in making healthcare decisions can enhance the effectiveness of the chosen representative.

Importance of Designation

Designating a Healthcare Power of Attorney is essential because it guarantees that your medical wishes are respected during times when you can’t communicate them yourself. This document empowers a trusted individual to make critical medical decisions on your behalf, ensuring your preferences are honored. Without this designation, your family might face confusion or conflict about your care, especially in emergencies. By choosing someone who understands your values and desires, you can alleviate stress for both your loved ones and healthcare providers. It’s important to discuss your wishes with your designated agent and review the document periodically. This way, you reinforce your intentions and ensure clarity when it matters most, providing peace of mind for you and your family.

Decision-Making Authority Clarity

To guarantee your healthcare wishes are honored, clarity in decision-making authority is essential. A Healthcare Power of Attorney designates a trusted person to make medical decisions on your behalf if you can’t communicate. This document ensures that your preferences are respected during critical moments. By clearly naming your agent, you reduce confusion among family members and healthcare providers, streamlining the decision-making process in emergencies. It’s important to draft this document carefully, ideally with legal counsel, to accurately reflect your wishes. Additionally, consider whether to combine it with an advance directive, which outlines your treatment preferences. This clarity not only protects your rights but also alleviates stress for your loved ones during challenging times. Furthermore, establishing a digital-friendly environment can enhance communication about your healthcare preferences with family members.

Potential Family Conflicts

While steering medical decisions can be challenging, having a Healthcare Power of Attorney in place can greatly reduce the potential for family conflicts. This document designates a trusted person to make medical choices on your behalf when you’re unable to communicate. Without it, family members might disagree on the best course of action, leading to stress and confusion in critical moments. By clearly outlining your wishes, you minimize the chance of disputes and ensure that your chosen advocate understands your preferences. It’s essential to discuss your decisions with your designated agent and family members, fostering open communication. This proactive approach not only eases your mind but also safeguards your family’s harmony during difficult times. Additionally, establishing a personalized learning pathway for understanding these documents can help ensure that all parties are informed and aligned.

TOMKID Fireproof Document Box, Fireproof File Box with Lids, Important Document Organizer Box with Lock, Portable File Folder Organizer with Handle

Fireproof and water-resistant safe: The exterior material of Fireproof File Box is made of upgraded anti-static silicone coated...

As an affiliate, we earn on qualifying purchases.

Crafting an Advance Directive or Living Will

When it comes to crafting an advance directive or living will, it’s essential to define your treatment preferences clearly. This document can help avoid family conflicts by ensuring everyone understands your wishes in case you can’t communicate them. Plus, being aware of the legal requirements in your state will make the process smoother and more effective. Additionally, understanding color accuracy can provide clarity on how your preferences may influence decisions related to your medical treatment.

Defining Treatment Preferences

Crafting an advance directive or living will is essential for guaranteeing that your medical treatment preferences are clearly communicated, especially in situations where you might be unable to voice them yourself. This document can guide healthcare providers and family members in making decisions that align with your wishes. Here are key elements to consider:

- Specify your preferences for life-sustaining treatments (e.g., ventilators, feeding tubes).

- State your wishes regarding resuscitation efforts.

- Decide on palliative care options if you can’t communicate.

- Include any religious or philosophical beliefs that influence your choices.

- Review and update your directive regularly to reflect changes in your health or preferences.

Taking these steps helps ensure your care aligns with your values, providing peace of mind for you and your loved ones. Additionally, it’s important to recognize that dreaming can enhance creativity and emotional resilience, which can be beneficial when considering your treatment preferences and overall well-being.

Avoiding Family Conflicts

Creating an advance directive or living will not only clarifies your medical preferences but also helps prevent potential conflicts among family members during difficult times. By outlining your wishes regarding treatments and end-of-life care, you reduce the burden on loved ones who might otherwise struggle to make tough decisions on your behalf. This document guarantees your voice is heard, even when you can’t speak for yourself. It also sets clear expectations, helping to minimize disagreements and emotional strain among family members. Remember, discussing your wishes with your family can further enhance understanding and cooperation. Taking these steps now can lead to peace of mind for you and your loved ones, ensuring that everyone is on the same page when it matters most. Additionally, understanding the importance of end-of-life care can significantly impact the decisions made by your family during critical moments.

Legal Requirements Overview

To guarantee your advance directive or living will is legally valid, you need to follow specific requirements that vary by state. Here are some key points to consider:

- Written Document: It must be in writing to be enforceable.

- Signature: You typically need to sign the document yourself or have someone sign on your behalf.

- Witnesses: Most states require one or more witnesses to validate your signature.

- Notarization: Some states may require the document to be notarized for added authenticity.

- State-Specific Forms: Check if your state has its own specific form to ensure compliance.

Additionally, it’s important to ensure that your advance directive is updated regularly to reflect your current health care wishes, as preferences can change over time and should align with your health care goals.

Benefits of a Revocable Living Trust

A revocable living trust offers several key advantages that can simplify estate planning and asset management. First, it allows your assets to transfer directly to beneficiaries after your death, avoiding the lengthy probate process. This can save time and reduce costs for your loved ones. You also maintain flexibility since you can modify or revoke the trust at any time during your lifetime. Additionally, a living trust helps keep your affairs private, as it doesn’t become a public record like a will does. This privacy is especially beneficial if you have minor or special needs beneficiaries, as the trust can provide ongoing management. Overall, a revocable living trust is a valuable tool in creating a thorough estate plan. Furthermore, like ethical hacking, it is essential to understand the importance of risk assessments to ensure that your estate is protected from unforeseen challenges.

The Role of Supporting Documents in Estate Planning

While estate planning often focuses on wills and trusts, supporting documents play a crucial role in ensuring your wishes are honored and your loved ones are protected. These documents can make a significant difference in how your estate is managed and how your intentions are communicated.

- Beneficiary designations on insurance and retirement accounts bypass probate.

- A list of assets and liabilities helps executors or trustees navigate your estate.

- HIPAA authorization allows designated individuals to access your medical information.

- Funeral instructions clarify your end-of-life wishes, easing family decision-making.

- Regular reviews of all documents ensure they reflect your current circumstances and legal requirements.

Keeping Beneficiary Designations Up to Date

Updating your beneficiary designations is just as important as preparing your estate planning documents. Life changes, like marriage, divorce, or the birth of a child, can affect who you want to inherit your assets. If you don’t keep these designations current, your wishes may not be honored, and your assets might not go to the intended recipients. Review your life insurance policies, retirement accounts, and payable-on-death accounts regularly. Confirm that your chosen beneficiaries reflect your current situation and relationships. Remember, designations generally bypass probate, making this task essential for a smooth transition of your assets. By staying proactive, you can prevent misunderstandings and ensure your legacy aligns with your intentions.

The Significance of Asset and Liability Lists

Creating an asset and liability list is essential for effective estate planning, as it provides a clear overview of your financial situation. This list not only helps you understand your net worth, but it’s also invaluable for your executor or trustee. By detailing your assets and liabilities, you can guarantee a smoother estate administration process.

Creating a comprehensive asset and liability list is vital for clear estate planning and smoother administration for your heirs.

- Identify all real estate and personal property

- List bank accounts, investments, and retirement funds

- Include outstanding debts like mortgages and loans

- Note any business interests or collectibles

- Outline insurance policies and their beneficiaries

This extensive view allows you to make informed decisions about your estate and helps prevent disputes among heirs. Take the time to create and maintain this list for your peace of mind.

Regularly Reviewing and Updating Estate Planning Documents

As life evolves, so do your circumstances and preferences, making it crucial to regularly review and update your estate planning documents. Changes like marriage, divorce, or the birth of a child can impact your wishes. At least once a year, take time to assess your Last Will, Powers of Attorney, and any Trusts. Confirm they reflect your current intentions and financial situation. Additionally, check beneficiary designations on insurance policies and retirement accounts, as these can override your will. Consulting with a legal professional can help clarify any necessary updates. By staying proactive, you’ll ensure your estate plan accurately represents your wishes and protects your loved ones when it matters most.

Frequently Asked Questions

What Happens if I Die Without a Will?

If you die without a will, your assets won’t be distributed according to your wishes. Instead, state laws dictate how everything’s divided, which can lead to delays and disputes among family members. Your estate may go through probate, a lengthy legal process where the court decides on asset distribution. Without clear directions, your loved ones might face unnecessary stress during an already difficult time. It’s vital to have a plan in place.

Can I Change My Will After It’s Created?

Yes, you can change your will after it’s created. You can add new provisions, modify existing ones, or even revoke it entirely. You just need to follow your state’s legal requirements, which may involve creating a new will or adding a codicil. Regularly updating your will guarantees it reflects your current wishes and circumstances. So, review it often and make changes as your life evolves—it’s your estate, and it should align with your desires.

How Do I Choose an Executor?

To select an executor, begin by contemplating someone you trust completely. They should be responsible, organized, and capable of managing financial matters. It’s wise to discuss the role with them beforehand to make certain they’re willing. Think about their familiarity with your wishes and family dynamics, too. You might want a professional, like a lawyer, if your estate is complex. Always review your choice periodically, especially after significant life changes.

Is a Living Trust Necessary if I Have a Will?

Imagine your assets flowing smoothly like a river, effortlessly reaching your beneficiaries. A living trust isn’t strictly necessary if you have a will, but it can simplify the process. It allows your assets to bypass probate, saving time and maintaining privacy. If you want flexibility and control over your estate during your lifetime, a living trust might be a wise addition. Consider your unique situation and consult a professional to explore options.

Can My Power of Attorney Be Contested?

Yes, your power of attorney can be contested. If someone believes you lacked the capacity to grant it, or if they suspect fraud or undue influence, they can challenge it in court. It’s vital to choose a reliable agent and guarantee the document is executed properly. Regularly reviewing your power of attorney can also help prevent disputes and make sure it accurately reflects your wishes, making it harder for others to contest its validity.

Conclusion

In the grand scheme of things, having a solid estate plan can make all the difference for you and your loved ones. By understanding essential documents like wills, powers of attorney, and trusts, you’re not just planning for the future—you’re ensuring peace of mind. Remember, it’s better to be safe than sorry. So, take the time to review and update your estate planning documents regularly, and you’ll keep everything running smoothly for years to come.