If you are taking money out of an IRA in Massachusetts, it is important to note that state taxes will be applied. Distributions from a Traditional IRA are subject to a flat rate of 5% in taxes. Make sure to report these on your state tax return using Schedule X, Line 2. If you are under 59 and a half years old, withdrawing funds may also result in a 10% federal penalty on top of state taxes. On the other hand, withdrawals from a Roth IRA can be tax-free if certain conditions are met. Nonresidents are not required to pay these taxes. Understanding these details can help you make the most of your retirement savings – there are additional tax strategies that could be advantageous to you.

Key Takeaways

- Massachusetts imposes a flat 5% state income tax on traditional IRA withdrawals for residents.

- Nonresidents are exempt from Massachusetts state income tax on IRA distributions.

- Roth IRA withdrawals may be tax-free if conditions, including age and account duration, are met.

- Public employer pensions are exempt from state taxation, while most other retirement incomes are taxable.

- Accurate record-keeping is essential for managing IRA withdrawals and understanding tax implications.

Massachusetts Tax Overview

When considering IRA withdrawals, understanding Massachusetts' tax implications is essential for your financial planning. Massachusetts imposes a flat income tax rate of 5% on most retirement account withdrawals, including distributions from IRAs. This means that when you withdraw funds from your IRA, you'll need to account for that tax hit in your overall financial strategy.

Residents must report IRA distributions on their state tax returns. Specifically, you'll need to use Schedule X, Line 2 for taxable distributions. If you're a nonresident, you're in luck; you won't owe Massachusetts state income tax on IRA distributions, as the state exempts nonresidents from this obligation.

Traditional IRA distributions are fully taxable in Massachusetts if they consist solely of deductible contributions. However, if you've made nondeductible contributions, these may create a cost basis that could influence how your distributions are taxed.

Massachusetts aligns its tax treatment of IRA rollovers with federal guidelines, allowing previously taxed contributions to be excluded from gross income during distributions. Understanding these rules can help you better navigate your financial landscape and minimize tax liabilities.

Taxation of IRA Withdrawals

Understanding the taxation of IRA withdrawals is essential for making informed financial decisions. In Massachusetts, distributions from traditional IRAs are fully taxable as state income. You must report these IRA distributions on your state tax return and complete Schedule X, Line 2 for taxable IRA/Keogh distributions.

If you're a part-year resident, only the distributions you received while you were a Massachusetts resident are taxable. Nonresidents, however, are exempt from state taxes on these distributions.

Be mindful of early withdrawals before age 59½, as they incur a 10% federal penalty in addition to Massachusetts tax implications. The state aligns its taxable rollover amounts with federal gross income, meaning previously taxed contributions are excluded from state taxation. This can impact your overall tax liability, so make certain you're aware of how it affects your financial planning.

Roth IRA distributions may be tax-free if certain conditions are met, which could provide additional advantages.

Traditional IRA Tax Implications

Withdrawals from traditional IRAs in Massachusetts come with specific tax implications that you need to contemplate. If you've only made deductible contributions, your distributions will be fully taxable as ordinary income.

However, if you've made nondeductible contributions, you'll have a cost basis that affects your tax liability on these taxable IRA distributions. This means not all of your withdrawal will be taxed, as the portion representing your nondeductible contributions is excluded.

As a Massachusetts resident, you must report your taxable IRA distributions on Schedule X, Line 2 of your state tax return. If you're a part-year resident, you'll only pay taxes on the distributions received while you were living in Massachusetts.

Nonresidents, on the other hand, are exempt from state taxation on these distributions.

To avoid double taxation, Massachusetts allows you to take a tax deduction for IRA distributions that match the amount of your previously taxed contributions. Understanding these nuances can help you minimize your state tax liability and make informed decisions about your traditional IRA withdrawals.

Roth IRA Tax Benefits

When you contribute to a Roth IRA, you access the potential for tax-free growth on your investments.

Once you meet the qualifying conditions, distributions can be taken without incurring state income tax, offering you significant financial advantages in retirement.

Understanding these benefits can help you make the most of your retirement strategy.

Tax-Free Growth Potential

Roth IRAs offer an exceptional opportunity for tax-free growth, allowing your investments to flourish without the burden of state or federal taxes, provided you meet certain conditions.

When you contribute to a Roth IRA, you're using after-tax dollars, meaning your contributions won't reduce your taxable income in the year you put them in. However, the real advantage comes into play during retirement when you can take qualified distributions tax-free.

In Massachusetts, Roth IRAs follow federal tax treatment, meaning that if you hold your account for at least five years and are over age 59½, your withdrawals won't be included in your gross income. This tax-free growth potential is significant, as it allows your investments to compound without the worry of future tax liabilities.

For 2023, you can contribute up to $6,500 annually, plus an additional $1,000 if you're 50 or older. This makes Roth IRAs an attractive option for those looking to maximize their retirement savings while enjoying the benefits of tax-free growth.

Qualified Distribution Advantages

Realizing the potential of qualified distributions from a Roth IRA can greatly enhance your retirement strategy. When you reach age 59½ and have held your account for at least five years, you gain access to tax-free withdrawals. This means your retirement savings can flourish without the burden of Massachusetts state income tax.

Here are some emotional benefits of taking advantage of qualified distributions:

- Peace of Mind: Knowing your earnings can be withdrawn tax-free provides financial security.

- Flexibility: You can withdraw contributions anytime without penalties, allowing you to access your funds if needed.

- Maximized Growth: Your investments grow tax-free, ensuring you keep more of your hard-earned money.

- Tax-Free Legacy: Leave your heirs a tax-free inheritance, adding value to your estate planning.

While contributions to a Roth IRA are made with after-tax dollars, the real advantage lies in the qualified distributions. Not only do you avoid state income tax on these withdrawals, but you also benefit from the federal tax treatment that aligns with Massachusetts law.

Embrace the Roth IRA for a flexible and tax-efficient retirement savings strategy!

Social Security Tax Exemption

Many retirees in Massachusetts find significant relief from the state income tax burden thanks to the full exemption of Social Security retirement benefits. This tax exemption allows you to keep more of your retirement income, which can be essential when managing your finances in retirement.

Unlike most other forms of retirement income that are subject to state taxes, Social Security benefits remain untouched, providing valuable financial support. The exemption applies regardless of your total income from other sources, meaning you can still benefit even if you have additional taxable income.

This structure is particularly beneficial in Massachusetts, where the high cost of living can put pressure on your finances. By incorporating the Social Security tax exemption into your financial planning strategy, you can guarantee that you maximize the income available to you in retirement.

Understanding this tax advantage can help you navigate your overall tax situation more effectively. As you prepare for retirement, keep in mind how this exemption can alleviate some of the financial burdens you may face, allowing you to enjoy your golden years with greater peace of mind.

Other Retirement Income Taxes

When planning your retirement finances in Massachusetts, you need to keep an eye on how other retirement income is taxed. Most retirement income, including distributions from 401(k)s and IRAs, is subject to a state income tax rate of 5%.

While public employer pensions are exempt from taxation, non-public employer pensions and other retirement accounts are taxable.

Here are some key points to reflect on:

- Social Security benefits are fully exempt from state income tax, offering some relief.

- Non-public employer pensions add to your taxable income, increasing your tax burden.

- An additional 4% tax kicks in for income exceeding $1 million from retirement accounts, totaling 9% for high earners.

- Massachusetts doesn't provide exemptions or deductions, making effective tax planning vital.

Being aware of these tax implications can help you make informed decisions about your retirement income.

You want to maximize your benefits while minimizing your tax liability. Understanding how different sources of retirement income are taxed is essential for maintaining your financial health in retirement.

State Income Tax Rates

When you withdraw from your IRA in Massachusetts, you'll face a flat state income tax rate of 5% on most earnings.

If you're a high earner, any income over $1 million gets hit with an additional 4%, totaling 9%.

Luckily, Social Security benefits are fully exempt from state taxes, giving you some breathing room in your retirement planning.

Current Income Tax Rate

In Massachusetts, you'll face a flat state income tax rate of 5% on most income, including withdrawals from your IRA. This consistent application of tax rates means that when you take taxable distributions from your retirement accounts, you'll want to verify you're prepared for the state income tax implications.

Here are some key points to reflect on:

- Plan your withdrawals wisely to minimize your tax burden.

- Understand how to report your IRA withdrawals on your state tax return.

- Be aware of additional taxes if your income exceeds $1 million.

- Nonresidents can benefit by not being taxed on IRA distributions received while living outside of Massachusetts.

When withdrawing funds from your IRA, remember that the current income tax rate applies to all taxable distributions, impacting your overall financial strategy.

To report your IRA withdrawals accurately, you'll need to fill out Schedule X, Line 2 on your state tax return. Being informed about the state income tax requirements can help you make the most of your retirement savings while avoiding unexpected costs.

Additional Tax for High Earners

High earners in Massachusetts face additional tax implications on their IRA withdrawals that can greatly impact their financial planning. If your income exceeds $1 million, you'll encounter an extra 4% state income tax on the portion above that threshold, bringing your total tax rate to 9% for that excess income.

This additional tax isn't limited to just IRA withdrawals; it applies to all forms of income, which means it's important to take into account the broader tax implications when planning your finances.

Massachusetts has a flat state income tax rate of 5% on most retirement income, including IRA distributions. Unfortunately, the state doesn't offer any deductions or exemptions for these withdrawals, so the entire amount you take out will be subject to the applicable tax rate.

As you prepare your state tax return, make sure you include all details of your IRA distributions. With the potential for significant tax liability, especially for high earners, it's vital to strategize effectively to minimize your state income tax burden and understand how these additional taxes may influence your overall financial situation.

Exemptions and Deductions Available

Many retirees may not realize that Massachusetts offers a tax deduction for IRA distributions, specifically up to the amount of previously taxed contributions. This can greatly reduce your tax liabilities, as Massachusetts imposes a flat state income tax rate of 5% on most IRA withdrawals.

If you're a high earner with income exceeding $1 million, be prepared for an additional 4% tax, totaling 9%.

Here are some key points to keep in mind:

- You can avoid double taxation by claiming deductions on your previously taxed contributions.

- Nonresidents are exempt from Massachusetts taxes on IRA distributions—only paying taxes in their home state.

- Traditional IRA distributions become fully taxable if only deductible contributions were made.

- Massachusetts lacks specific exemptions for IRA withdrawals, making careful planning vital.

Understanding these tax deductions is essential for maximizing your retirement plans. With proper planning, you can navigate potential tax liabilities and make the most of your hard-earned savings.

Property and Sales Tax Insights

Massachusetts residents face a unique tax landscape, with a statewide sales tax of 6.25% applied to most tangible goods and services. Unlike many states, there aren't additional local taxes, so you know exactly what to expect at checkout.

However, essential items like groceries, clothing priced under $175, and prescription drugs qualify for exemptions from sales tax, helping lighten your overall tax burden.

On the property tax front, Massachusetts has a median effective property tax rate of 1.19% of the assessed value of your home, markedly higher than the national average. If you live in more expensive areas like Cape Cod or Boston, the property taxes can be particularly steep, especially given the median home value of around $424,700.

Fortunately, homeowners can take advantage of various property tax exemptions based on age, disability, or veteran status, potentially lowering their tax liabilities considerably.

For those pursuing higher education, keep in mind that certain educational expenses mightn't be subject to sales tax, making it easier to manage the costs associated with schooling.

Understanding these tax insights can help you navigate your financial obligations more effectively.

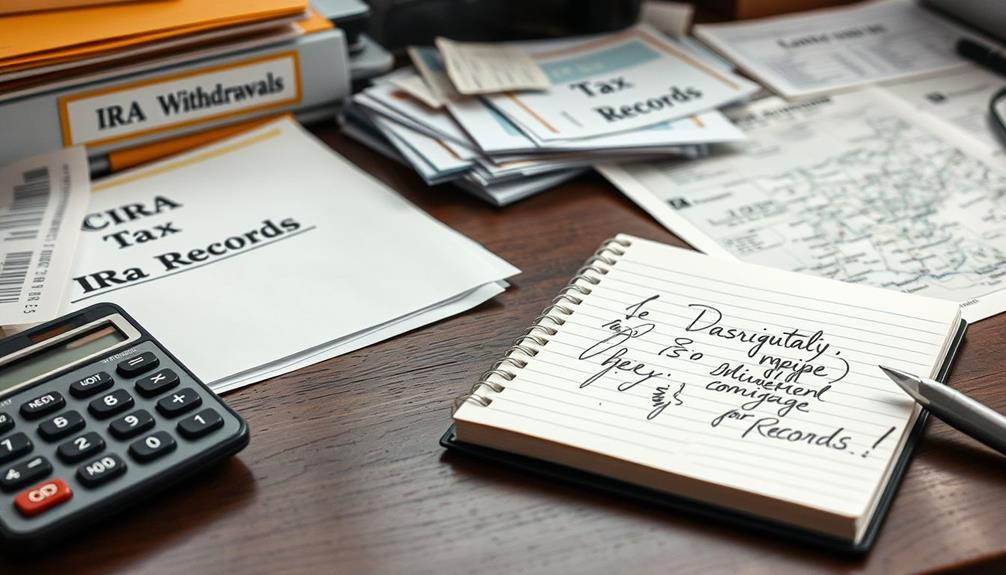

Record Keeping Requirements

When it comes to IRA withdrawals, keeping accurate records is vital.

You'll need to maintain essential documentation like bank statements and Form 1099-R to support your tax reporting.

This guarantees you meet the reporting requirements and can claim any deductions or exemptions correctly.

Essential Documentation to Maintain

Maintaining thorough documentation is essential for effectively managing your IRA withdrawals and meeting state tax requirements. In Massachusetts, it's vital to keep accurate records of all contributions and distributions from your IRA account. This guarantees you're compliant with both state and federal tax reporting.

Here's what you should document:

- Bank statements that reflect your IRA transactions

- Form 1099-R for distributions taken from your IRA

- Records of nondeductible contributions to traditional IRAs, as they affect your cost basis

- Residency documentation if you're a nonresident, to clarify your tax obligations

Reporting Requirements Overview

How do you guarantee you're meeting your state's reporting requirements for IRA withdrawals? For Massachusetts residents, it starts with completing Schedule X, Line 2 on your state tax return to report taxable IRA distributions.

Accurate record-keeping is essential. You'll need to maintain documentation, including bank statements and Form 1099-R, to make certain you can substantiate your claims during tax season.

If you're a part-year resident, remember that you're only taxed on IRA distributions received while living in Massachusetts. You'll need to use specific worksheets to report these amounts correctly.

Nonresidents, on the other hand, have it easier; they're exempt from state taxes on IRA distributions and don't need to report these amounts on their Massachusetts tax returns.

Staying organized and guaranteeing compliance with both state and federal reporting requirements will help you avoid penalties and make your tax filings related to IRA withdrawals as smooth as possible.

Always double-check your documentation and understand your obligations based on your residency status to stay on the right side of the law.

Strategies for Tax Efficiency

Several effective strategies can help you maximize tax efficiency when withdrawing from your IRA. By understanding the implications of state taxes in Massachusetts, you can make informed decisions that will minimize your overall tax burden.

- Consider converting traditional IRAs to Roth IRAs during lower-income years.

- Avoid early withdrawals before age 59½ to sidestep the 10% federal penalty.

- Remember that nondeductible contributions can be deducted from traditional IRAs to reduce taxable amounts.

- Take advantage of tax-free withdrawals from Roth IRAs after five years for those over 59½.

These strategies not only enhance your tax efficiency but also allow for more significant growth and flexibility in your retirement savings.

By planning your IRA withdrawals carefully, you can mitigate the impact of the 5% flat state income tax on your distributions.

Keep in mind that timing is vital; the right moves can save you substantial amounts in taxes.

Whether you're maneuvering through traditional IRAs or considering the benefits of Roth IRAs, strategic planning is key.

Embrace these strategies to guarantee your retirement funds go further, allowing you to enjoy the fruits of your labor without the sting of heavy taxation.

Frequently Asked Questions

Does Massachusetts Tax IRA Withdrawals?

Yes, Massachusetts taxes IRA withdrawals as ordinary income. You'll need to report these distributions on your state tax return. Remember, nonresidents living outside Massachusetts aren't subject to this tax on their IRA distributions.

Do You Pay State Taxes on IRA Withdrawals?

Did you know that nearly 80% of retirees rely on IRA withdrawals for income? Yes, you pay state taxes on IRA withdrawals, depending on your state's rules and whether you're a resident or nonresident.

What States Have Mandatory State Tax Withholding on IRA Distributions?

Many states have mandatory state tax withholding on IRA distributions. For instance, New Jersey requires 10% withholding, while Massachusetts has a flat 5%. Always check your state's specific regulations to understand your obligations.

Does Massachusetts Tax Inherited IRA Distributions?

In Massachusetts, inherited IRA distributions are taxed at a flat rate of 5%. If you earn over $1 million, an additional 4% applies. Keep accurate records to guarantee compliance when reporting your taxable income.

Conclusion

Maneuvering Massachusetts tax implications for IRA withdrawals can feel overwhelming, but you're not alone. Just as you plan for your future, remember that every decision you make today shapes your financial landscape tomorrow. By understanding how traditional and Roth IRAs affect your taxes, you can maximize your benefits and minimize burdens. Coincidentally, this journey toward tax efficiency not only secures your finances but also gives you peace of mind, allowing you to enjoy your hard-earned retirement.